يعمل مجلس معايير المحاسبة المالية (FASB) بجدية على تحديث التدوين المحاسبي لتكون متناسبة مع المعايير والإرشادات الصادرة عن لجنة الأوراق المالية والبورصات (SEC). وقد قام المجلس بإصدار تحديث للمعايير المحاسبية (ASU) يضمن تضمين 14 متطلبًا جديدًا يتعلق بالكشف عن المعلومات والتقارير الخاصة بالكيانات المالية.

تتناول هذه التحديثات مجموعة واسعة من المواضيع التي تؤثر على كيانات متنوعة تخضع لمبادئ المحاسبة المقبولة على نطاق واسع (GAAP). يهدف المجلس من خلال هذه التحديثات إلى توضيح وتحسين متطلبات الكشف والعرض، مما يسهل على المستخدمين مقارنة البيانات بين الكيانات التي تخضع لمتطلبات SEC الحالية وتلك التي لم تكن تخضع لها في السابق.

يتضمن التحديث القسم التمهيدي الذي يلخص الإفصاحات الصادرة عن SEC في رقم 10532-33 بعنوان "تحديث الإفصاح وتبسيطه". تم إدراج هذا التحديث في تدوين FASB بتاريخ 17 أغسطس 2018.

وفقًا للبيان الصحفي الصادر عن FASB، تهدف التحديثات إلى تيسير المقارنة بين الكيانات الملتزمة بمتطلبات الإفصاحات الحالية لـ SEC وتلك التي ليست ملتزمة بها، مع مواءمة متطلبات التدوين مع لوائح SEC. وفيما يتعلق بتواريخ الفعل الفعلي للتعديلات، أشار المجلس إلى أنه في حالة الكيانات الملتزمة بمتطلبات SEC الحالية، سيتم تفعيل التعديل فور إزالة SEC للإفصاح ذي الصلة من قواعدها. أما بالنسبة للكيانات الأخرى، فستكون التعديلات سارية المفعول بعد عامين، ما لم تقم SEC بإزالة الإفصاح ذي الصلة من لوائحها بحلول 30 يونيو 2027. في هذه الحالة، ستتم إزالة التعديلات من التدوين ولن تكون سارية المفعول لأي كيان.

ونكتب لكم ماتحتويه هذه التحديثات التي تم اصدارها :

Accounting Standards Update

No. 2023-06

October 2023

Disclosure Improvements

Codification Amendments in Response to the SEC’s Disclosure Update and Simplification Initiative

An Amendment of the FASB Accounting Standards Codification®

Financial Accounting Standards Board

801 Main Avenue・Norwalk, CT・06851

Accounting Standards Update 2023-06

Disclosure Improvements

Codification Amendments in Response to the SEC’s Disclosure Update and Simplification Initiative

October 2023

Summary

![]()

Why Is the FASB Issuing This Accounting Standards Update (Update)?

In U.S. Securities and Exchange Commission (SEC) Release No. 33-10532, Disclosure Update and Simplification, issued August 17, 2018, the SEC referred certain of its disclosure requirements that overlap with, but require incremental information to, generally accepted accounting principles (GAAP) to the FASB for potential incorporation into the Codification. The amendments in this Update are the result of the Board’s decision to incorporate into the Codification 14 of the 27 disclosures referred by the SEC.

Who Is Affected by the Amendments in This Update?

The amendments in this Update affect a variety of Topics in the Codification. The amendments apply to all reporting entities within the scope of the affected Topics unless otherwise indicated.

What Are the Main Provisions?

The amendments in this Update modify the disclosure or presentation requirements of a variety of Topics in the Codification. Certain of the amendments represent clarifications to or technical corrections of the current requirements. Because of the variety of Topics amended, a broad range of entities may be affected by one or more of those amendments. The amendments are summarized in the Introduction section of the Update.

How Do the Main Provisions Differ from Current Generally Accepted Accounting Principles (GAAP) and Why Are They an Improvement?

The amendments in this Update represent changes to clarify or improve disclosure and presentation requirements of a variety of Topics. Many of the amendments allow users to more easily compare entities subject to the SEC’s existing disclosures with those entities that were not previously subject to the SEC’s requirements. Also, the amendments align the requirements in the Codification with the SEC’s regulations.

When Will the Amendments Be Effective and What Are the Transition Requirements?

For entities subject to the SEC’s existing disclosure requirements and for entities required to file or furnish financial statements with or to the SEC in preparation for the sale of or for purposes of issuing securities that are not subject to contractual restrictions on transfer, the effective date for each amendment will be the date on which the SEC’s removal of that related disclosure from Regulation S-X or Regulation S-K becomes effective, with early adoption prohibited. For all other entities, the amendments will be effective two years later.

The amendments in this Update should be applied prospectively.

For all entities, if by June 30, 2027, the SEC has not removed the applicable requirement from Regulation S-X or Regulation S-K, the pending content of the related amendment will be removed from the Codification and will not become effective for any entity.

Amendments to the

FASB Accounting Standards Codification®

![]()

Introduction

1. The following table provides a summary of the amendments to the Accounting Standards Codification.

|

Codification Subtopic |

Summary of Amendments |

|

230-10 Statement of Cash Flows—Overall |

Requires an accounting policy disclosure in annual periods of where cash flows associated with derivative instruments and their related gains and losses are presented in the statement of cash flows. |

|

250-10 Accounting Changes and Error Corrections— Overall |

Requires that when there has been a change in the reporting entity, the entity disclose any material prior-period adjustment and the effect of the adjustment on retained earnings in interim financial statements. |

|

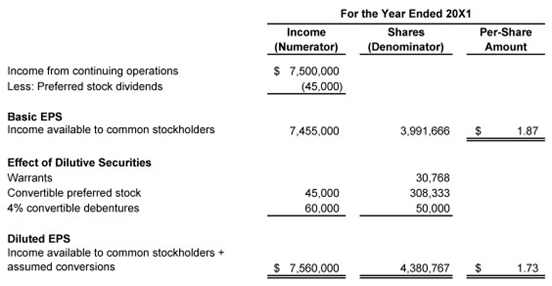

260-10 Earnings Per Share— Overall |

Requires disclosure of the methods used in the diluted earnings-per-share computation for each dilutive security and clarifies that certain disclosures should be made during interim periods.

Amends illustrative guidance to illustrate disclosure of the methods used in the diluted earnings-per-share computation. |

|

270-10 Interim Reporting— Overall |

Conforms to the amendments made to Topic 250. |

|

440-10 Commitments—Overall |

Requires disclosure of assets mortgaged, pledged, or otherwise subject to lien and the obligations collateralized. |

|

470-10 Debt—Overall |

Requires disclosure of amounts and terms of unused lines of credit and unfunded |

|

Codification Subtopic |

Summary of Amendments |

|

commitments and the weighted-average interest rate on outstanding short-term borrowings. Entities that are not public business entities are not required to provide information about the weighted-average interest rate. |

|

|

505-10 Equity—Overall |

Requires entities that issue preferred stock to disclose preference in involuntary liquidation if the liquidation preference is other than par or stated value. |

|

815-10 Derivatives and Hedging—Overall |

Adds cross-reference to disclosure requirements related to where cash flows associated with derivative instruments and their related gains and losses are presented in the statement of cash flows in Topic 230. |

|

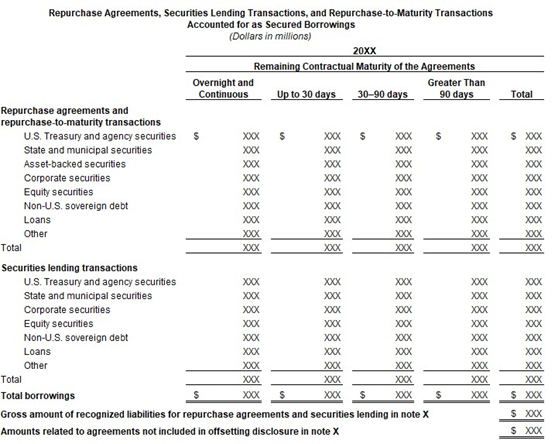

860-30 Transfers and Servicing—Secured Borrowing and Collateral |

Requires: a. That accrued interest be included in the disclosure of liabilities incurred in securities borrowing or repurchase or resale transactions b. Separate presentation of the aggregate carrying amount of reverse repurchase agreements on the face of the balance sheet if that amount exceeds 10 percent of total assets c. Disclosure of the weighted-average interest rates of repurchase liabilities for public business entities d. Disclosure of amounts at risk with an individual counterparty if that amount exceeds more than 10 percent of stockholder’s equity e. Disclosure for reverse repurchase agreements that exceed 10 percent of total assets on whether there are any provisions in a reverse repurchase agreement to ensure that the market value of the underlying assets remains sufficient to protect against counterparty default and, if so, the nature of those provisions. |

|

Codification Subtopic |

Summary of Amendments |

|

932-235 Extractive Activities— Oil and Gas—Notes to Financial Statements |

Requires that paragraphs 932-235-50-3 through 50-36 be applicable for each annual period presented in the financial statements. |

|

946-20 Financial Services— Investment Companies— Investment Company Activities |

Requires that investment companies disclose the components of capital on the balance sheet. |

|

974-10 Real Estate—Real Estate Investment Trusts—Overall |

Requires disclosure for annual reporting periods of the tax status of distributions per unit (for example, ordinary income, capital gain, and return of capital) for a real estate investment trust. |

2.

The Accounting Standards

Codification is amended as described in paragraphs 3–30. In some cases, to put

the change in context, not only are the amended paragraphs shown but also the

preceding and following paragraphs. Terms from the Master Glossary are in bold type. Added text is underlined, and deleted text is struck out.

Amendments to Master Glossary

3. Add the Master Glossary term Change in the Reporting Entity to Subtopic 270-10 as follows:

Change in the Reporting Entity

A change that results in financial statements that, in effect, are those of a different reporting entity. A change in the reporting entity is limited mainly to the following:

a. Presenting consolidated or combined financial statements in place of financial statements of individual entities

b. Changing specific subsidiaries that make up the group of entities for which consolidated financial statements are presented

c. Changing the entities included in combined financial statements.

Neither a business combination accounted for by the acquisition method nor the consolidation of a variable interest entity (VIE) pursuant to Topic 810 is a change in reporting entity.

4. Add the Master Glossary term Public Business Entity to Subtopics 47010 and 860-30 as follows:

Public Business Entity

A public business entity is a business entity meeting any one of the criteria below. Neither a not-for-profit entity nor an employee benefit plan is a business entity.

a. It is required by the U.S. Securities and Exchange Commission (SEC) to file or furnish financial statements, or does file or furnish financial statements (including voluntary filers), with the SEC (including other entities whose financial statements or financial information are required to be or are included in a filing).

b. It is required by the Securities Exchange Act of 1934 (the Act), as amended, or rules or regulations promulgated under the Act, to file or furnish financial statements with a regulatory agency other than the SEC.

c. It is required to file or furnish financial statements with a foreign or domestic regulatory agency in preparation for the sale of or for purposes of issuing securities that are not subject to contractual restrictions on transfer.

d. It has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market.

e. It has one or more securities that are not subject to contractual restrictions on transfer, and it is required by law, contract, or regulation to prepare U.S. GAAP financial statements (including notes) and make them publicly available on a periodic basis (for example, interim or annual periods). An entity must meet both of these conditions to meet this criterion.

An entity may meet the definition of a public business entity solely because its financial statements or financial information is included in another entity’s filing with the SEC. In that case, the entity is only a public business entity for purposes of financial statements that are filed or furnished with the SEC.

Amendments to Subtopic 230-10

5. Add paragraph 230-10-50-9 and its related heading, with a link to transition paragraph 105-10-65-7, as follows:

Statement of Cash Flows—Overall Disclosure

> Accounting Policy for Derivative Instruments

230-10-50-9 An entity shall disclose its accounting policy for where cash flows associated with derivative instruments and their related gains and losses are presented.

Amendments to Subtopic 250-10

6. Amend paragraph 250-10-50-6, with a link to transition paragraph 10510-65-7, as follows:

Accounting Changes and Error Corrections—Overall Disclosure

> Accounting Changes

• > Change in Reporting Entity

250-10-50-6 When there has been a change in the reporting entity, the financial statements of both the interim period of the change and the annual period of the change shall describe the nature of the change and the reason for it. In addition, the effect of the change on income from continuing operations, net income (or other appropriate captions of changes in the applicable net assets or performance indicator), other comprehensive income, and any related per-share amounts shall be disclosed for all periods presented. The cumulative effect of the change on retained earnings or other appropriate components of equity or net assets in the statement of financial position as of the beginning of the earliest period presented also shall be disclosed. Financial statements of subsequent periods need not repeat the disclosures required by this paragraph. If a change in reporting entity does not have a material effect in the period of change but is reasonably certain to have a material effect in later periods, the nature of and reason for the change shall be disclosed whenever the financial statements of the period of change are presented. See paragraph 270-10-45-12 for additional guidance related to accounting changes in interim periods. (Sections 805-10-50, 805-20-50, 805-30-50, and 805-74050 describe the manner of reporting and the disclosures required for a business combination.)

Amendments to Subtopic 260-10

7. Amend paragraphs 260-10-50-1 and 260-10-55-51 through 55-52, with a link to transition paragraph 105-10-65-7, as follows:

Earnings Per Share—Overall Disclosure

260-10-50-1 For each period for which an income statement is presented, including interim periods, an entity shall disclose all of the following:

a. A reconciliation of the numerators and the denominators of the basic and diluted per-share computations for income from continuing operations. The reconciliation shall include the individual income and share amount effects of all securities that affect earnings per share (EPS). Example 2 (see paragraph 260-10-55-51) illustrates that disclosure. (See paragraph 260-10-45-3.) An entity is encouraged to refer to pertinent information about securities included in the EPS computations that is provided elsewhere in the financial statements as prescribed by Subtopic 505-10.

b. The effect that has been given to preferred dividends in arriving at income available to common stockholders in computing basic EPS.

c. Securities (including those issuable pursuant to contingent stock agreements) that could potentially dilute basic EPS in the future that were not included in the computation of diluted EPS because to do so would have been antidilutive for the period(s) presented. Full disclosure of the terms and conditions of these securities is required even if a security is not included in diluted EPS in the current period.

d. The methods used in the diluted EPS computation for each type of dilutive instrument (for example, treasury stock method, if-converted method, two-class method, or reverse treasury stock method).

Implementation Guidance and Illustrations

> Illustrations

• > Example 2: EPS Disclosures

260-10-55-51 This Example illustrates the reconciliation of the numerators and denominators of the basic and diluted EPS computations for income from continuing operations and other related disclosures required by paragraph 260-10-50-1 for Entity A in Example 1. This disclosure is required in both interim and annual periods. Note that Topic 718 has specific disclosure requirements related to share-based compensation arrangements.

260-10-55-52 The following table illustrates the computation of basic and diluted EPS for the year

ended 20X1.

Diluted EPS was computed using the treasury stock method for warrants and the if-converted method for convertible instruments. Options to purchase 1,000,000 shares of common stock at $85 per share were outstanding during the second half of 20X1 but were not included in the computation of diluted

EPS because the options’ exercise price was greater than the average market price of the common shares. The options, which expire on June 30, 20Y1, were still outstanding at the end of year 20X1.

Amendments to Subtopic 270-10

8. Amend paragraphs 270-10-45-12, 270-10-45-19, and 270-10-50-1, with a link to transition paragraph 105-10-65-7, as follows:

Interim Reporting—Overall Other Presentation Matters

> Accounting Changes in Interim Periods

270-10-45-12 Each

report of interim financial information shall indicate any change in accounting principles or , change in practices, or change in the reporting

entity from those applied in any of the following:

a. The comparable interim period of the prior annual period

b. The preceding interim periods in the current annual period

c. The prior annual report.

> Guidance Related to Presentation of Other Topics at Interim Dates

270-10-45-19 The following may not represent all references to interim reporting:

a. For accounting changes, see paragraphs 250-10-45-14 through 45-16 and 250-10-45-21.

b. For comprehensive income, see paragraph 220-10-45-18.

c. For incurred but not reported liability and interim reporting, see paragraphs 720-20-35-3 through 35-5 and 720-20-35-8.

d. For income tax provisions, see Subtopic 740-270.

e. For inventory, see paragraphs 330-10-55-2 and 610-30-25-3.

f. For pensions and other postretirement benefits, see paragraphs 71520-55-18 through 55-19 and 715-60-35-40. Disclosure

> Disclosure of Summarized Interim Financial Data by Publicly Traded Companies

270-10-50-1 Many publicly traded companies report summarized financial information at periodic interim dates in considerably less detail than that provided in annual financial statements. While this information provides more timely information than would result if complete financial statements were issued at the end of each interim period, the timeliness of presentation may be partially offset by a reduction in detail in the information provided. As a result, certain guides as to minimum disclosure are desirable. (It should be recognized that the minimum disclosures of summarized interim financial data required of publicly traded companies do not constitute a fair presentation of financial position and results of operations in conformity with generally accepted accounting principles [GAAP].) If publicly traded companies report summarized financial information at interim dates (including reports on fourth quarters), the following data should be reported, as a minimum:

a. Sales or gross revenues, provision for income taxes, net income, and comprehensive income

b. Basic and diluted earnings per share data for each period presented, determined in accordance with the provisions of Topic 260

c. Seasonal revenue, costs, or expenses (see paragraph 270-10-45-11)

d. Significant changes in estimates or provisions for income taxes (see paragraphs 740-270-30-2, 740-270-30-6, and 740-270-30-8)

e. Disposal of a component of an entity and unusual or infrequently occurring items (see paragraphs 270-10-45-11A and 270-10-50-5)

f. Contingent items (see paragraph 270-10-50-6)

g. Changes in accounting principles

principles, or changes in accounting estimates, or changes in the reporting entity

(see paragraphs 270-10-45-12 through 45-16)

[The remainder of this paragraph is not shown here because it is unchanged.]

Amendments to Subtopic 440-10

9. Amend paragraph 440-10-50-1, with a link to transition paragraph 10510-65-7, as follows:

Commitments—Overall Disclosure

440-10-50-1 Notwithstanding more explicit disclosures required elsewhere in this Codification, all of the following situations shall be disclosed in financial statements:

a. Unused letters of credit

b. Leases (see Section 842-20-50)

c. Assets mortgaged, pledged, or otherwise subject to lien; the approximate amounts of those assets; and the

related obligations collateralized as

security for loans

d. Pension plans (see Section 715-20-50)

e. The existence of cumulative preferred stock dividends in arrears

f. Commitments, including:

1. A commitment for plant acquisition

2. An obligation to reduce debts

3. An obligation to maintain working capital

4. An obligation to restrict dividends.

Amendments to Subtopic 470-10

10. Amend paragraph 470-10-15-1 and add paragraphs 470-10-50-6 through 50-7 and their related headings, with a link to transition paragraph 105-10-657, as follows:

Debt—Overall Scope and Scope Exceptions

> Entities

470-10-15-1 The guidance in this Subtopic applies to all entities, excluding paragraph 470-10-50-7, which applies to public business entities only.

Disclosure

> Unused Commitments and Lines of Credit

470-10-50-6 An entity shall separately disclose the following in the notes to financial statements:

a. The amount and terms of unused commitments for long-term financing arrangements (including commitment fees and the conditions under which commitments may be withdrawn)

b. The amount and terms of unused lines of credit for short-term financing arrangements (including commitment fees and the conditions under which lines may be withdrawn) and the amount of those lines of credit that support commercial paper borrowing arrangements or similar arrangements.

> Weighted-Average Interest Rate on Short-Term Borrowings

470-10-50-7 A public business entity shall disclose the weighted-average interest rate on short-term borrowings outstanding as of the date of each balance sheet presented.

Amendments to Subtopic 505-10

11. Amend paragraph 505-10-50-4, with a link to transition paragraph 10510-65-7, as follows:

Equity—Overall Disclosure

> Securities with Preferences

505-10-50-4 An

entity that issues preferred stock

(or other senior stock) that has a preference in involuntary liquidation considerably

in excess of the other than par or stated value of the shares shall

disclose the liquidation preference of the stock (the relationship between the

preference in liquidation and the par or stated value of the shares). That

disclosure shall be made in the equity section of the statement of financial

position in the aggregate, either parenthetically or in short, rather than on a

per-share basis or through disclosure in the notes.

Amendments to Subtopic 815-10

12. Add paragraph 815-10-50-8C and its related heading, with a link to transition paragraph 105-10-65-7, as follows:

Derivatives and Hedging—Overall Disclosure

> Accounting Policy for Statement of Cash Flows

815-10-50-8C See paragraph 230-10-50-9 for disclosure requirements related to where cash flows associated with derivative instruments and their related gains and losses are presented in the statement of cash flows.

Amendments to Subtopic 860-30

13. Amend paragraphs 860-30-15-1, 860-30-45-2 through 45-3, 860-30-50-7, and 860-30-55-4 and add paragraphs 860-30-45-2A and 860-30-50-9 through 50-12 and their related heading, with a link to transition paragraph 105-10-657, as follows:

Transfers and Servicing—Secured Borrowing and Collateral Scope and Scope Exceptions

> Overall Guidance

860-30-15-1 This Subtopic follows the same Scope and Scope Exceptions as outlined in the Overall Subtopic, see Section 860-10-15, with specific transaction qualifications noted below. Paragraph 860-30-50-7(d) applies to public business entities only.

Other Presentation Matters

860-30-45-1 If the secured party (transferee) has the right by contract or custom to sell or repledge the collateral, then the obligor (transferor) shall reclassify that asset and report that asset in its statement of financial position separately (for example, as security pledged to creditors) from other assets not so encumbered.

860-30-45-2 Liabilities, including accrued interest, incurred by either the secured party or obligor in securities borrowing or resale transactions shall be separately classified.

860-30-45-2A If as of the date of the most recent statement of financial position the aggregate carrying amount of reverse repurchase agreements (securities or other assets purchased under agreements to resell) exceeds 10 percent of total assets, the assets shall be separately classified.

860-30-45-3 This Section does not specify the classification or the terminology to be used to describe the following:

a. Pledged assets reclassified by the transferor of securities loaned or transferred under a repurchase agreement accounted for as a collateralized borrowing if the transferee is permitted to sell or repledge those securities

b. Liabilities, including accrued interest, incurred by either the secured party or obligor in securities borrowing or resale transactions.

Example 1 (see paragraph 860-30-55-1) illustrates possible classifications and terminology.

Disclosure

860-30-50-1A An entity shall disclose all of the following for collateral:

a. If the entity has entered into repurchase agreements or securities lending transactions, it shall disclose its policy for requiring collateral or other security.

b. As of the date of the latest statement of financial position presented, both of the following:

1. The carrying amount and classifications of both of the following:

i. Any assets pledged as collateral that are not reclassified and separately reported in the statement of financial position in accordance with paragraph 860-30-25-5(a)

ii. Associated liabilities.

2. Qualitative information about the relationship(s) between those assets and associated liabilities; for example, if assets are restricted solely to satisfy a specific obligation, a description of the nature of restrictions placed on those assets.

c. If the entity has accepted collateral that it is permitted by contract or custom to sell or repledge, it shall disclose all of the following:

1. The fair value as of the date of each statement of financial position presented of that collateral

2. The fair value as of the date of each statement of financial position presented of the portion of that collateral that it has sold or repledged

3. Information about the sources and uses of that collateral. For overall guidance on Topic 860’s disclosures, see Section 860-10-50. > Disclosures for Repurchase Agreements, Securities Lending

Transactions, and Repurchase-to-Maturity Transactions

860-30-50-7 To provide an understanding of the nature and risks of short-term collateralized financing obtained through repurchase agreements, securities lending transactions, and repurchase-to-maturity transactions, that are accounted for as secured borrowings at the reporting date, an entity shall disclose the following information for each interim and annual period about the collateral pledged and the associated risks to which the transferor continues to be exposed after the transfer:

a. A disaggregation of the gross obligation by the class of collateral pledged. An entity shall determine the appropriate level of disaggregation and classes to be presented on the basis of the nature, characteristics, and risks of the collateral pledged.

1. Total borrowings under those agreements shall be reconciled to the amount of the gross liability for repurchase agreements and securities lending transactions disclosed in accordance with paragraph 210-20-50-3(a) before any adjustments for offsetting. Any difference between the amount of the gross obligation disclosed under this paragraph and the amount disclosed in accordance with paragraph 210-20-50-3(a) shall be presented as reconciling item(s).

b. The remaining contractual maturity of the repurchase agreements, securities lending transactions, and repurchase-to-maturity transactions. An entity shall use judgment to determine an appropriate range of maturity intervals that would convey an understanding of the overall maturity profile of the entity’s financing agreements.

c. A discussion of the potential risks associated with the agreements and related collateral pledged, including obligations arising from a decline in the fair value of the collateral pledged and how those risks are managed.

d. For a public business entity, the weighted-average interest rate of the repurchase liability and the related repurchase liability.

>

Disclosures for Counterparty Risk for Repurchase Agreements, ![]() Securities

Lending Transactions, and Repurchase-to-Maturity

Securities

Lending Transactions, and Repurchase-to-Maturity

Transactions

860-30-50-9 If as of the date of the most recent statement of financial position the amount at risk under repurchase agreements or the amount at risk under reverse repurchase agreements with any individual counterparty or group of related counterparties exceeds 10 percent of stockholders’ equity, an entity shall disclose the name(s) of those counterparties or group of related counterparties, the amount at risk with each, and the weighted-average maturity of the repurchase agreements or reverse repurchase agreements with each.

860-30-50-10 As used in this Subtopic, the amount at risk under repurchase agreements is the excess of the carrying amount (or market value, if higher than the carrying amount or if there is no carrying amount) of the securities or other assets sold under agreement to repurchase, including accrued interest plus any cash or other assets on deposit to secure the repurchase obligation, over the amount of the repurchase liability (adjusted for accrued interest).

860-30-50-11 As used in this Subtopic, the amount at risk under reverse repurchase agreements is the excess of the carrying amount of the reverse repurchase agreements over the market value of assets delivered in accordance with the agreements by the counterparty to an entity (or to a thirdparty agent that has affirmatively agreed to act on behalf of the entity) and not returned to the counterparty, except in exchange for their approximate market value in a separate transaction.

860-30-50-12 If the aggregate carrying amount of reverse repurchase agreements exceeds 10 percent of total assets as described in paragraph 86030-45-2A, an entity shall disclose whether there are any provisions to ensure that the market value of the underlying assets remains sufficient to protect the entity in the event that the counterparty defaults and, if so, the nature of those provisions.

Implementation Guidance and Illustrations

> Illustrations • > Example 2: Disclosures for Repurchase Agreements, Securities Lending Transactions, and Repurchase-to-Maturity Transactions Accounted for as Secured Borrowings

860-30-55-4 This

Example illustrates one approach for satisfying the quantitative disclosure

requirements in paragraph 860-30-50-7(a)

through (b) 860-30-50-7.

Amendments to Subtopic 932-235

14. Add paragraph 932-235-50-2A, with a link to transition paragraph 105-1065-7, as follows:

Extractive Activities—Oil and Gas—Notes to Financial Statements Disclosure

> Publicly Traded Companies

932-235-50-2A For disclosure requirements in paragraphs 932-235-50-3 through 50-36, an entity shall disclose all of the following:

a. Information that relates to annual periods for each annual period for which a statement of comprehensive income is required

b. Information required as of the end of an annual period for which a balance sheet is required

c. Information required as of the beginning of an annual period for each annual period for which a statement of comprehensive income is required.

Amendments to Subtopic 946-20

15. Amend paragraph 946-20-50-11, with a link to transition paragraph 10510-65-7, as follows:

Financial Services—Investment Companies—Investment Company Activities Disclosure

> Components of Capital and Distributable Earnings

946-20-50-11 This

guidance requires all investment companies to disclose only two

components of capital on the balance sheet: shareholder capital and

distributable earnings. The components of distributable earnings, on a tax

basis, shall be disclosed in a note to financial statements. This information

enables investors to determine the amount of accumulated and undistributed

earnings they potentially could receive in the future and on which they could

be taxed.

946-20-50-12 The notes shall disclose all of the following tax-basis components of distributable earnings as of the most recent tax year end:

a. Undistributed ordinary income

b. Undistributed long-term capital gains

c. Capital loss carryforwards

d. Unrealized appreciation (depreciation).

Amendments to Subtopic 974-10

16. Add Section 974-10-50, with a link to transition paragraph 105-10-65-7, as follows:

Real Estate—Real Estate Investment Trusts—Overall Disclosure

General

974-10-50-1 For annual reporting periods, an entity shall disclose the tax status of distributions per unit (for example, ordinary income, capital gain, and return of capital).

Amendments to Subtopic 105-10

17. Add paragraphs 105-10-65-7 through 65-8 and their related heading as follows:

Generally Accepted Accounting Principles—Overall Transition and Open Effective Date Information

> Transition Related to Accounting Standards Update No. 2023-06, Disclosure Improvements: Codification Amendments in Response to the SEC’s Disclosure Update and Simplification Initiative

105-10-65-7 The following represents the transition and effective date information related to Accounting Standards Update No. 2023-06, Disclosure Improvements: Codification Amendments in Response to the SEC’s Disclosure Update and Simplification Initiative:

a. For all entities subject to the Securities and Exchange Commission’s (SEC) existing disclosure requirements and for entities required to file or furnish financial statements with or to the SEC in preparation for the sale of or for purposes of issuing securities that are not subject to contractual restrictions on transfer, each amendment in the pending content that links to this paragraph shall become effective on the date that the SEC’s removal of the related guidance from Regulation S-X or Regulation S-K becomes effective. An entity shall apply the pending content that links to this paragraph to financial statements issued after the effective date. Early adoption is prohibited. Paragraph 105-10-65-8 includes a cross-reference to Regulation S-X and Regulation S-K for the pending content that links to this paragraph.

b. For all other entities, each amendment in the pending content that links to this paragraph shall be effective two years after the pending content becomes effective for entities referred to in paragraph 105-10-65-7(a).

c. The pending content that links to any related requirements not removed by the SEC from Regulation S-X or Regulation S-K by June 30, 2027, will be removed from the Codification and will not become effective for any entity.

d. An entity shall apply the pending content that links to this paragraph prospectively to financial statements issued after the effective date.

105-10-65-8 The following represents a cross-reference to Regulation S-X or Regulation S-K for the pending content that links to paragraph 105-10-65-7:

|

SEC Rule |

Codification Paragraph |

|

Regulation S-K Item 302(b) |

932-235-50-2A |

|

Regulation S-X Rule 10-01(b)(2) |

260-10-50-1 260-10-55-51 through 55-52 |

|

Regulation S-X Rule 10-01(b)(7) |

250-10-50-6 270-10-45-12 270-10-45-19 270-10-50-1 |

|

Regulation S-X Rule 3-15(c) |

974-10-50-1 |

|

Regulation S-X Rule 4-08(b) |

440-10-50-1 |

|

Regulation S-X Rule 4-08(d) |

505-10-50-4 |

|

Regulation S-X Rule 4-08(m) |

860-30-15-1 860-30-45-2 through 45-3 860-30-50-7 860-30-50-9 through 50-12 860-30-55-4 |

|

Regulation S-X Rule 4-08(n) |

230-10-50-9 815-10-50-8C |

|

Regulation S-X Rule 5-02.19(b) |

470-10-15-1 470-10-50-6 through 50-7 |

|

Regulation S-X Rule 6-04.17 |

946-20-50-11 |

Amendments to Status Sections

18. Amend paragraph 105-10-00-1, by adding the following items to the table, as follows:

105-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

105-10-65-7 |

Added |

2023-06 |

10/09/2023 |

|

105-10-65-8 |

Added |

2023-06 |

10/09/2023 |

19. Amend paragraph 230-10-00-1, by adding the following item to the table, as follows:

230-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

230-10-50-9 |

Added |

2023-06 |

10/09/2023 |

20. Amend paragraph 250-10-00-1, by adding the following item to the table, as follows:

250-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

250-10-50-6 |

Amended |

2023-06 |

10/09/2023 |

21. Amend paragraph 260-10-00-1, by adding the following items to the table, as follows:

260-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

260-10-50-1 |

Amended |

2023-06 |

10/09/2023 |

|

260-10-55-51 |

Amended |

2023-06 |

10/09/2023 |

|

260-10-55-52 |

Amended |

2023-06 |

10/09/2023 |

22. Amend paragraph 270-10-00-1, by adding the following items to the table, as follows:

270-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

Change in the Reporting Entity |

Added |

2023-06 |

10/09/2023 |

|

270-10-45-12 |

Amended |

2023-06 |

10/09/2023 |

|

270-10-45-19 |

Amended |

2023-06 |

10/09/2023 |

|

270-10-50-1 |

Amended |

2023-06 |

10/09/2023 |

23. Amend paragraph 440-10-00-1, by adding the following item to the table, as follows:

440-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

440-10-50-1 |

Amended |

2023-06 |

10/09/2023 |

24. Amend paragraph 470-10-00-1, by adding the following items to the table, as follows:

470-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

Not-for-Profit Entity |

Added |

2023-06 |

10/09/2023 |

|

Public Business Entity |

Added |

2023-06 |

10/09/2023 |

|

Security |

Added |

2023-06 |

10/09/2023 |

|

470-10-15-1 |

Amended |

2023-06 |

10/09/2023 |

|

470-10-50-6 |

Added |

2023-06 |

10/09/2023 |

|

470-10-50-7 |

Added |

2023-06 |

10/09/2023 |

25. Amend paragraph 505-10-00-1, by adding the following item to the table, as follows:

505-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

505-10-50-4 |

Amended |

2023-06 |

10/09/2023 |

26. Amend paragraph 815-10-00-1, by adding the following item to the table, as follows:

815-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

815-10-50-8C |

Added |

2023-06 |

10/09/2023 |

27. Amend paragraph 860-30-00-1, by adding the following items to the table, as follows:

860-30-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

Not-for-Profit Entity |

Added |

2023-06 |

10/09/2023 |

|

Public Business Entity |

Added |

2023-06 |

10/09/2023 |

|

Security |

Added |

2023-06 |

10/09/2023 |

|

860-30-15-1 |

Amended |

2023-06 |

10/09/2023 |

|

860-30-45-2 |

Amended |

2023-06 |

10/09/2023 |

|

860-30-45-2A |

Added |

2023-06 |

10/09/2023 |

|

860-30-45-3 |

Amended |

2023-06 |

10/09/2023 |

|

860-30-50-7 |

Amended |

2023-06 |

10/09/2023 |

|

860-30-50-9 through 50-12 |

Added |

2023-06 |

10/09/2023 |

|

860-30-55-4 |

Amended |

2023-06 |

10/09/2023 |

28. Amend paragraph 932-235-00-1, by adding the following item to the table, as follows:

932-235-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

932-235-50-2A |

Added |

2023-06 |

10/09/2023 |

29. Amend paragraph 946-20-00-1, by adding the following item to the table, as follows:

946-20-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

946-20-50-11 |

Amended |

2023-06 |

10/09/2023 |

30. Amend paragraph 974-10-00-1, by adding the following item to the table, as follows:

974-10-00-1 The following table identifies the changes made to this Subtopic.

|

Paragraph |

Action |

Accounting Standards Update |

Date |

|

974-10-50-1 |

Added |

2023-06 |

10/09/2023 |

The amendments in this Update were adopted by the unanimous vote of the seven members of the Financial Accounting Standards Board:

Richard R. Jones, Chair

James L. Kroeker, Vice Chairman

Christine A. Botosan

Frederick L. Cannon

Susan M. Cosper

Marsha L. Hunt

Dr. Joyce T. Joseph

Background Information and Basis for Conclusions

![]()

Introduction

BC1. The following summarizes the Board’s considerations in reaching the conclusions in this Update. It includes reasons for accepting certain approaches and rejecting others. Individual Board members gave greater weight to some factors than to others.

Background Information

BC2. On July 13, 2016, the SEC proposed amendments to certain of its disclosure requirements that were potentially duplicative, overlapping, or outdated considering the SEC’s other disclosure requirements, the Codification, or changes in the information environment. The SEC received approximately 70 comment letters from a variety of stakeholders. The SEC issued final amendments in Release No. 33-10532, Disclosure Update and Simplification, on August 17, 2018, in which the SEC referred to the FASB certain of its disclosure requirements that overlap with, but require incremental information to, GAAP for potential incorporation into the Codification. The referred disclosures affect a variety of Codification Topics.

BC3. The referred disclosures originate in either Regulation S-X or Regulation S-K within the SEC’s rules and regulations. Regulation S-X governs the form and content of, as well as the requirements for, financial statements filed with the SEC. In a public business entity’s annual report on Form 10-K, Regulation S-X governs the information included in Item 8, Financial Statements and Supplementary Data, which includes the notes to financial statements. Regulation S-K governs the integrated disclosure requirements for the content of the nonfinancial statement portions of SEC filings, which is effectively all content outside Item 8, for example, general information related to business descriptions, properties, and legal proceedings, as well as management’s discussion and analysis of financial condition and results of operations. Therefore, incorporating the incremental requirements from

Regulation S-X into the Codification would not affect what is included in the audited financial statements of an entity subject to the SEC’s existing disclosure requirements. However, incorporating the incremental requirements from Regulation S-K into the Codification could affect what is included in the audited financial statements for an entity subject to the SEC’s existing disclosure requirements. Additionally, incorporating any SEC disclosure requirements into the Codification could affect the financial statements of an entity not subject to the SEC’s existing disclosure requirements.

BC4. In December 2013, the Board issued the Private Company DecisionMaking Framework: A Guide for Evaluating Financial Accounting and Reporting for Private Companies, which assists the Board and the Private Company Council (PCC) in determining, among other things, whether and in what circumstances to provide alternative disclosure requirements for private companies reporting under GAAP. The Board used the Private Company Decision-Making Framework, in conjunction with feedback received from the PCC on the amendments in this Update, to determine whether the referred disclosures should apply to entities other than public business entities.

BC5. On May 6, 2019, the Board issued proposed Accounting Standards Update, Disclosure Improvements: Codification Amendments in Response to the SEC’s Disclosure Update and Simplification Initiative, with comments due on June 28, 2019. The Board received 16 comment letters in response to the amendments in that proposed Update. The Board considered respondents’ comments in reaching the conclusions in this Update, as discussed further below.

Benefits and Costs

BC6. The objective of financial reporting is to provide information that is useful to present and potential investors, creditors, donors, and other allocators of capital in making rational investment, credit, and similar resource allocation decisions. However, the benefits of providing information for that purpose should justify the related costs. Present and potential investors, creditors, donors, and other allocators of capital benefit from improvements in financial reporting, while the costs to implement new guidance are borne primarily by present investors and other allocators of capital. The Board’s assessment of the costs and benefits of issuing new guidance is unavoidably more qualitative than quantitative because there is no method to objectively measure the costs to implement new guidance or to quantify the value of improved information in financial statements.

BC7. The Board concluded that the amendments in this Update will be cost neutral for entities subject to the SEC’s existing disclosure requirements because those entities must comply with the SEC’s guidance regardless of the Codification’s disclosure requirements. Specifically, the Board noted that the amendments resulting from the referred disclosures that are included in Regulation S-X will not affect audit costs of entities subject to the SEC’s existing disclosure requirements because those disclosures are included in the audited financial statements. The amendments resulting from incorporating the Regulation S-K referred disclosures into the Codification move those disclosures from the nonfinancial statement portions of SEC filings to the notes to financial statements, but the Board concluded that preparation costs associated with doing so will be minimal given the nature of those disclosures. The amendments align the disclosure requirements in the Codification with the SEC’s disclosure requirements, which makes GAAP easier to apply for entities that are SEC registrants.

BC8. For entities not subject to the SEC’s existing disclosure requirements, there likely will be costs to comply with the amendments in this Update. However, on the basis of feedback from the PCC and comment letter respondents, the Board has considered and provided certain exceptions to the disclosure requirements for entities other than public business entities in accordance with the Private Company Decision-Making Framework as warranted. As a result of the comments received and the exceptions provided, the Board concluded that the costs are not expected to be significant for entities not subject to the SEC’s existing disclosure requirements. The Board also noted that aligning disclosure requirements improves consistency between public and private companies, which benefits users of other than public business entity financial statements and may reduce costs if a nonpublic entity decides to become a public entity. The amendments do not create new accounting requirements other than additional disclosures for which the Board expects that the information should be readily available.

Basis for Conclusions

Referred Disclosures Incorporated into the Codification

BC9. Comment letter respondents supported many of the amendments in the proposed Update. For certain proposed amendments, comment letter respondents suggested clarifications to make the amendments operable and decision useful. For other proposed amendments, for which specific comment letter feedback is not described below, comment letter respondents did not provide substantive feedback, or their feedback supported the Board’s decisions. This section summarizes the Board’s considerations for the decisions about amendments to incorporate certain referred disclosures into the Codification.

BC10. The Board evaluated each of the proposed amendments under the Private Company Decision-Making Framework to assess whether any differences in disclosure requirements were warranted for private companies. PCC members and comment letter respondents provided feedback on whether certain referred disclosures would be meaningful to investors and other financial statement users of private company financial statements and whether providing the information would be costly for private company preparers. In general, the feedback from PCC members and comment letter respondents supported incorporating the majority of the referred disclosures into the Codification. The Board considered whether different disclosure requirements for private companies (and other nonpublic entities) were warranted.

Derivative Accounting Policies under Topic 230, Statement of Cash Flows

BC11. Regulation S-X Rule 4-08(n) requires that an entity disclose “where in the statement of cash flows derivative financial instruments, and their related gains and losses, as defined by U.S. generally accepted accounting principles, are reported.” Topic 815, Derivatives and Hedging, however, only requires those disclosures for the statement of financial position and results of operations. The Board decided that an entity should disclose where cash flows from derivative instruments and their related gains and losses are presented in the statement of cash flows. Consistent with the accounting policy disclosure requirements in paragraphs 235-10-50-1 through 50-2, the Board decided that the disclosure applies to annual reporting periods and the interim reporting period in which the reporting entity changes its accounting policies since the end of its preceding fiscal year. This disclosure will provide information about the effect of derivatives on all relevant measures of financial performance.

Interim Changes in Reporting Entity under Topic 250, Accounting Changes and Error Corrections

BC12. Regulation S-X Rule 10-01(b)(7) requires that an entity disclose (a) any material retroactive prior-period adjustment related to changes in reporting entities made during any period covered by interim financial statements and (b) the effect of the adjustment on net income (total and per share) and retained earnings. Regulation S-X Rule 8-03(b)(5) provides similar requirements for smaller reporting companies but does not require that an entity disclose the effect of the adjustment on retained earnings. Topic 250 already addresses the accounting for and reporting of a change in accounting principle or the correction of an error. It requires that an entity disclose the effect of the adjustment on net income and retained earnings and, if applicable, provide required disclosures in the interim financial statements. However, if there has been a change in reporting entity, Topic 250 is unclear whether an entity should disclose the effect of the change on retained earnings and, if applicable, provide disclosures in the interim financial statements.

BC13. The Board decided that (a) requiring that all entities disclose the effect of that change on retained earnings or other components of equity or net assets and (b) clarifying that disclosure of changes in reporting entities should be made in interim periods will improve the guidance in Topic 250 and align it with the guidance for a change in accounting principle in that Topic. The Board noted that the amendment that requires that all entities disclose the effect of a change in reporting entity on retained earnings will increase the number of entities that provide such a disclosure because Regulation S-X Rule 8-03(b)(5) does not require that smaller reporting companies disclose the effect on retained earnings. However, the Board also noted that the change should not be costly because the effect on retained earnings will be known when an entity recasts its financial statements.

Interim Financial Statements under Topic 260, Earnings per Share

BC14. Regulation S-X Rule 10-01(b)(2) requires that “the basis of the earnings per share computation shall be stated together with the number of shares used in the computation” in interim financial statements. The Board observed that paragraph 260-10-50-1 requires that an entity provide a reconciliation of the numerator and the denominator used in the computation of earnings per share “for each period for which an income statement is presented,” which can be interpreted to include interim financial statements. The Board acknowledged, however, that some stakeholders could interpret that guidance as requiring disclosure only for each of the years for which an income statement is presented in the annual financial statements. The Board also noted that diluted earnings per share can be calculated using several different methods (for example, the treasury stock method, the reverse treasury stock method, the if-converted method, and the two-class method), depending on the facts and circumstances, and that the effects of the method used can change each period. Therefore, the Board decided that requiring that an entity disclose the methods used in the diluted earnings-per-share calculation in interim periods and clarifying that the earnings-per-share disclosures in paragraph 260-10-50-1 should be provided in interim periods will provide investors, creditors, and other allocators of capital with decision-useful information about the earnings-per-share calculation.

Assets Subject to Lien under Topic 440, Commitments

BC15. Regulation S-X Rule 4-08(b) requires that “assets mortgaged, pledged, or otherwise subject to lien, and the approximate amounts thereof, shall be designated and the obligations collateralized briefly identified.” The Board noted that although Topic 440 and Topic 860, Transfers and Servicing, include disclosure requirements for specific circumstances, there is no general requirement in the Codification to disclose all assets subject to lien. The Board decided that a general requirement will provide investors, creditors, donors, and other allocators of capital (collectively, “investors”) with decision-useful information about all instances in which assets may be subject to lien.

Unused Commitments and Other Disclosures under Topic 470, Debt

BC16. Regulation S-X Rule 5-02.19(b) requires that an entity disclose in the notes to financial statements the amount and terms of unused lines of credit for short-term financing. Additionally, it requires that an entity disclose the weighted-average interest rate for short-term borrowings outstanding at each balance sheet date. If the lines of credit support a commercial paper borrowing arrangement (or similar arrangement), that fact also must be disclosed. Similarly, Regulation S-X Rule 5-02.22(b) requires that an entity disclose the amount and terms of unused commitments for long-term financing arrangements. Topic 470 does not contain similar disclosure requirements.

BC17. The Board observed that information about existing obligations and potential obligations along with the relevant details of those obligations (for example, borrowing capacity and interest rates) provides investors with important information about an entity’s resources and access to resources. At present, investors rely on the availability of that information for public business entities in assessing liquidity and leverage. Therefore, the Board decided that the referred disclosures about unused lines of credit or unused commitments for both short-term and long-term financing arrangements will provide investors with decision-useful information. In response to comment letter feedback, the Board decided to clarify that entities should separately disclose the amounts and terms of unused commitments for long-term financing arrangements, unused lines of credit for short-term financing, and amounts of lines of credit that support commercial paper borrowing arrangements.

BC18. In the proposed Update, the Board decided that the proposed amendment to disclose the weighted-average interest rate on short-term borrowings (see the amendment in paragraph 470-10-50-7) should be required for all entities. Feedback from PCC members and comment letter respondents supported an exemption for entities other than public business entities because the proposed disclosure of the weighted-average interest rate for short-term borrowings could be costly and complex to prepare. PCC members and comment letter respondents also noted that investors can estimate the weighted-average interest rate on their own using other available information in the financial statements. In response to comment letter feedback and analysis of the Private Company Decision-Making Framework, the Board decided that the benefits of disclosing the weighted-average interest rate do not outweigh the cost for other than public business entities. Therefore, the Board decided that the amendment in paragraph 470-10-50-7 should apply only to public business entities.

Preferred Shares under Topic 505, Equity

BC19. Regulation S-X Rule 4-08(d) states that “aggregate preferences on involuntary liquidation, if other than par or stated value, shall be shown parenthetically in the equity section of the balance sheet.” Topic 505 has a similar disclosure requirement with a slight variation. Paragraph 505-10-50-4 requires disclosure if the preference on involuntary liquidation is “considerably in excess” of the par or stated value. The Board noted that the term considerably in excess is subjective and may require that an entity exercise judgment to determine whether it is required to provide that disclosure. That judgment may lead to variations in the quality and quantity of disclosures made about preferences on involuntary liquidation. The Board decided that the amendment to paragraph 505-10-50-4 will simplify existing GAAP and improve the consistency of disclosures related to preferences on involuntary liquidation.

Repurchase and Reverse Repurchase Agreements under Topic 860, Transfers and Servicing

BC20. Regulation S-X Rule 4-08(m) includes several presentation and disclosure requirements for repurchase agreements and reverse repurchase agreements that are incremental to the requirements in Topic 860. Regulation S-X Rule 4-08(m) requires that an entity disclose the liability (including accrued interest payable), the associated interest rate, amounts at risk with an individual counterparty if that amount exceeds more than 10 percent of stockholders’ equity, reverse repurchase agreements in which the aggregate carrying amount exceeds 10 percent of total assets, and whether there are any provisions in a reverse repurchase agreement to ensure that the market value of the underlying assets remains sufficient to protect against counterparty default. The Board decided to amend the Codification to incorporate the referred disclosures because repurchase agreements and reverse repurchase agreements are complex transactions and the disclosures will provide investors with useful information about those transactions.

BC21. The amendment in paragraphs 860-30-45-2 and 860-30-45-3(b) clarifies that accrued interest should be included in the presentation of the repurchase agreement liability. The Board decided that this clarification will reduce diversity in practice. The amendment in paragraph 860-30-45-2A requires that reverse repurchase agreements be classified separately if the carrying amount exceeds 10 percent of total assets, which is consistent with the existing requirement in paragraphs 860-30-45-2 and 860-30-45-3(b) to classify separately repurchase agreement liabilities (albeit without the 10 percent of total assets threshold). The Board considered whether to require or adjust the bright-line threshold of 10 percent of total assets. The Board noted that repurchase agreements are most often entered into by financial institutions, but reverse repurchase agreements are entered into by various types of entities. Therefore, the Board noted that having a threshold in the guidance will require the disclosure only for those entities that have significant reverse repurchase agreements.

BC22. The amendment in paragraph 860-30-50-7 requires that public business entities disclose the weighted-average interest rate on the repurchase liability to further enhance the information provided. Some Board members noted that entities involved with repurchase agreements tend to have more sophisticated accounting operations and can perform a weightedaverage interest rate calculation. For reasons similar to those described in paragraph BC18 and feedback from the PCC, however, the Board decided that entities that are not public business entities will not be required to disclose the weighted-average interest rate on repurchase liabilities because of the cost and complexity of that calculation.

BC23. The Board also decided that the amendments on counterparty risk in paragraphs 860-30-50-9 through 50-12 will provide investors with important decision-useful information about those risks. The Board decided to retain the use of the term market value in the amendment. Because that term is consistent with the language in the SEC’s requirements, maintaining this language will help reduce the likelihood of changes to current practice.

Supplemental Information under Topic 932, Extractive Activities—Oil and Gas

BC24. Regulation S-K Item 302(b) provides requirements for supplemental financial information for oil- and gas-producing activities for SEC registrants. Regulation S-K Item 302(b) indicates that the disclosures should be presented in accordance with Subtopic 932-235, Extractive Activities—Oil and Gas— Notes to Financial Statements. Regulation S-K Item 302(b) states that disclosures that relate to annual periods should be presented for each annual period for which a specified financial statement is required. The Board decided that clarifying that the supplemental information in Subtopic 932-235 is required for each annual period for which a specified financial statement is required will improve GAAP by removing any ambiguity. The Board also noted that the clarification will not be costly for preparers because they should have the information from when it was disclosed in prior periods.

Technical Correction for Topic 946, Financial Services— Investment Companies

BC25. The SEC staff recommended that the Board clarify the requirements in paragraph 946-20-50-11 because the language conflicts with the illustrative example in paragraph 946-830-55-12. Paragraph 946-20-50-11 states:

This guidance requires all investment companies to disclose only two components of capital on the balance sheet: shareholder capital and distributable earnings. The components of distributable earnings, on a tax basis, shall be disclosed in a note to financial statements. This information enables investors to determine the amount of accumulated and undistributed earnings they potentially could receive in the future and on which they could be taxed.

However, the illustration in paragraph 946-830-55-12 disaggregates the components of distributable earnings on the balance sheet, which contradicts the term only in paragraph 946-20-50-11. The Board noted that paragraph 94620-50-11 provides minimum requirements rather than prescriptive requirements for the term only. The Board determined that deleting the term only will clarify Subtopic 946-20, Financial Services—Investment Companies— Investment Company Activities, and remove any perceived inconsistency in the Codification.

Tax Status under Topic 974, Real Estate—Real Estate Investment Trusts

BC26. Regulation S-X Rule 3-15(c) requires that a real estate investment trust disclose the tax status of distributions per unit (for example, ordinary income and capital gain). Investors’ feedback provided to the Board indicated that although current investors have access to tax forms that provide such information, potential investors will benefit from information about the tax status of distributions before they decide to invest. Therefore, the Board decided that an entity should disclose the tax status of distributions per unit that relate to the annual period for a real estate investment trust. The Board also considered whether the scope of the referred disclosure should be expanded to include other types of pass-through entities but determined that existing disclosure requirements in other Topics are sufficient. For example, paragraph 946-2050-8 requires that investment companies, which represent a significant type of pass-through entity, disclose the tax status of dividends.

Referred Disclosures Not Incorporated into the Codification

BC27. This section summarizes the Board’s considerations for deciding not to incorporate certain referred disclosures into the Codification. It is divided into two subsections: (a) those disclosures not incorporated into the proposed Update and (b) those disclosures not incorporated into the Codification based on comment letter feedback. Those disclosures are still required by the SEC in either Regulation S-X or Regulation S-K unless the SEC makes further changes. Comment letter respondents provided overwhelming support for the Board’s decision not to include the disclosures in the Codification.

Disclosures Not Incorporated into the Proposed Update

BC28. This section summarizes the disclosures that the Board decided not to incorporate into the amendments in the proposed Update.

BC29. Regulation S-K Item 201(d) requires that an entity disclose the formula, if any, for calculating the number of shares available for issuance under an equity compensation plan. The Board noted that Topic 718, Compensation—Stock Compensation, requires that an entity disclose the number of shares available for issuance. Feedback from some investors indicated that the formula for calculating the number of shares available for issuance under an equity compensation plan is not meaningful because an entity’s board of directors has the authority to increase the number of shares available for issuance if, and when, needed (subject to shareholder or other approval as applicable). Some Board members disagreed with that feedback and indicated that this disclosure provides investors with decision-useful information. The Board decided that whether or not the formula for calculating the number of shares available for issuance under an equity compensation plan is meaningful, that disclosure is more appropriately provided outside the financial statements. Therefore, the Board decided not to add to the Codification a requirement that would have had an entity disclose the formula for calculating the number of shares available for issuance under an equity compensation plan.

BC30. Regulation S-X Rule 4-07 requires that discounts on shares (or any unamortized balance) be shown separately as a deduction from equity accounts either on the face of the balance sheet or in the notes to financial statements. The Board noted that the disclosure requirement in Regulation S-X Rule 4-07 was important under previous accounting practice in which stock issuance costs were amortized, which no longer is permitted under current GAAP. The Board observed that in applying Topic 230, entities generally disclose stock issuance costs in the period of issuance, which provides investors with sufficient information about the existence of those discounts. The Board also noted that other discounts to par or stated value (aside from issuance costs) are addressed by other disclosure requirements in the Codification. Therefore, the Board decided not to incorporate the referred disclosure into the Codification.

BC31. When the SEC referred the disclosure, Regulation S-K Item 101(c)(1)(vii) required that an entity disclose the name of any customer that represents more than 10 percent of the entity’s consolidated revenues. However, in August 2020, the SEC adopted amendments to make the disclosures in Regulation S-K Item 101(c) more principles based and removed the 10 percent threshold, thereby eliminating Regulation S-K Item 101(C)(1)(vii). Topic 280, Segment Reporting, requires that an entity disclose the existence of major customers and utilizes a 10 percent threshold in defining a major customer; however, an entity is not required to disclose the identity of a major customer under Topic 280. The Board received investor feedback that indicated that disclosing the names of major customers is important. However, the Board considered whether disclosing the names of major customers could result in competitive harm to entities subject to the disclosure. The Board decided that the objective of disclosing information about major customers is to signal the existence of concentration risk and that the existing disclosure requirement in paragraph 280-10-50-42 provides investors with sufficient information about concentration risk without disclosing the names of major customers. Therefore, the Board decided not to incorporate the names of major customers into the requirements in Topic 280.

BC32. Regulation S-X Rule 4-08(f) requires that an entity disclose any significant changes in the authorized or issued amounts of bonds, mortgages, or similar debt since the date of the latest balance sheet. The Board noted that the issuance of a bond or debt after the balance sheet date but before the financial statements are issued is included as an example in Topic 855, Subsequent Events, of a nonrecognized subsequent event that should be disclosed. A change in the authorized amounts of bonds, however, is not mentioned as an example. Feedback from both preparers and users indicated that information about changes in the authorized amount of debt is less meaningful because an entity’s board of directors likely would need to approve the terms of the issuance of significant debt even if there is authorized debt outstanding. Additionally, the Board noted that if a preparer determines that, given its facts and circumstances, changes in the authorized amount of debt after the balance sheet date but before the financial statements are issued have a material effect on the financial statements, the preparer would be required to disclose that information in accordance with the existing guidance in Topic 855. Therefore, the Board decided not to incorporate into the Codification the disclosure of changes in the authorized amount of debt as a prescribed subsequent event.

BC33. Regulation S-X Rule 4-08(k)(1) states that “amounts of related party transactions should be stated on the face of the balance sheet, statement of comprehensive income, or statement of cash flows.” The Board decided that the disclosure requirements in Topic 850, Related Party Disclosures, provide an appropriate level of detail for material related party transactions that allows investors to understand the nature of those transactions and whether terms other than arm’s length were offered. Therefore, the Board decided not to incorporate the referred disclosure into the Codification.

Disclosures Not Incorporated Based on Comment Letter Feedback

BC34. This section summarizes the Board’s decisions, based on comment letter feedback, not to incorporate into the Codification certain amendments that had been included in the proposed Update.

BC35. Regulation S-K Item 101(c) provides requirements for the description of a business within the annual report on Form 10-K. When the SEC referred the disclosure, it required that an entity disclose each class of similar products or services that contributed to 10 percent or more of consolidated revenue. However, in August 2020, the SEC adopted amendments to Regulation S-K Item 101(c) that removed the 10 percent threshold, making the disclosure principles based. Topic 280 requires that an entity disclose the revenues for each product and service or each group of similar products and services unless it is impracticable to do so. Regulation S-K Item 101(c)(1)(i) does not include an impracticability exception. The Board had proposed removing the impracticability exception from paragraph 280-10-50-40 but in redeliberations decided that such a change would increase costs and introduce operability concerns for preparers. The operability concerns cited by comment letter respondents included information availability and volume of product mix diluting the decision usefulness of the disclosure. Therefore, the Board decided not to incorporate that amendment into the Codification.

BC36. Regulation S-X Rule 10-01(b)(3) requires “supplemental disclosure of the separate results of the combined entities for periods prior to the combination” when a combination between entities under common control occurs in an interim period. A combination of entities under common control is an example of a change in the reporting entity, and the amendments in paragraph 250-10-50-6 provide sufficient information about these types of transactions to achieve the objectives of the referred disclosure. Therefore, the Board decided that it is unnecessary to also add this requirement to Topic 805, Business Combinations.

BC37. Regulation S-X Rule 3A-03(b) requires that an entity newly included in or excluded from consolidated financial statements be disclosed by name if it has a material effect on the financial statements. Comment letter respondents noted that Topic 805 and Topic 810, Consolidation, contain disclosure requirements about consolidated and deconsolidated entities that achieve objectives similar to that of Regulation S-X Rule 3A-03(b). The Board agreed with those comment letter respondents and decided that adequate information about consolidated and deconsolidated entities is already required by Topic 805 and Topic 810 to achieve the objectives of this referred disclosure.

BC38. Regulation S-X Rule 3-20(d) addresses how an entity should determine the functional currency of a reporting entity and how to translate the functional currency financial statements of a reporting entity into a reporting currency that is different from its functional currency. Topic 830, Foreign Currency Matters, also provides guidance on how to determine an entity’s functional currency and how to translate the functional currency financial statements into a reporting currency. However, Topic 830 may be interpreted to apply only to foreign subsidiaries of a reporting entity because it does not explicitly address the functional currency determination of the reporting entity itself. The Board observed that most entities that report under GAAP have a functional currency that is the same as their reporting currency but that certain reporting entities, such as foreign private issuers registered with the SEC, may decide to present their financial statements in U.S. dollars even though their functional currency is in another currency. Comment letter respondents expressed concerns that the amendments in the proposed Update would create unintended confusion and operability challenges. The Board decided that the additional amendments to Topic 830 that would be needed to address the functional currency determination of a reporting entity are beyond the scope of the SEC’s referred disclosure and, therefore, decided not to incorporate the amendments into the Codification.

BC39. Regulation S-X Rule 4-08(k)(2) requires disclosure in separate financial statements of any intra-entity profits or losses resulting from transactions with related parties. Comment letter respondents noted that Topic 850 requires various disclosures about transactions with related parties that provide sufficient information about these types of transactions to achieve the objectives of the referred disclosure. The Board agreed with those comment letter respondents and decided that Topic 850 provides adequate information about related party transactions.

Other Referred Disclosures Not Included in This Update